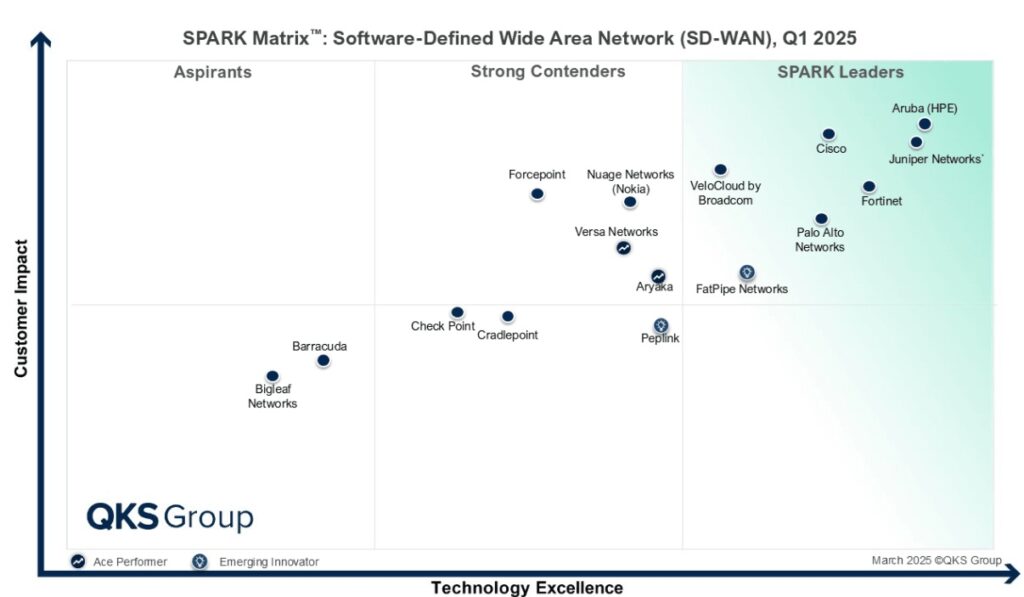

While we have already analyzed the 2023-2024 market situation, a lot can change in a year. Especially with the current industry landscape becoming completely upended by the continued strengthening of newer technologies like AI, it is important to compare the market situation in 2025 with 2024 to see who has adopted the newer technologies in a better manner than their peers and thus provide products that are up to date with the current networking landscape. So, without further ado, here is the 2024-2025 comparison of key players in the Software Defined-Wide Area Network (SD-WAN) market. Let us start with a table outlining all the players that participated in the research:

| Vendor | 2024 Position | 2025 Position | Movement pattern |

| VMware | Leader | Missing | Missing; likely rebranded under Broadcom VeloCloud. |

| VeloCloud (Broadcom) | Not present | SPARK Leader | Re-emerges as Leader. |

| Fortinet | Leader | Leader | Maintains strong position. |

| Cisco | Leader | Leader | Slight shift left but strong. |

| Juniper Networks | Leader | Leader | Improved position in tech excellence & impact. |

| Palo Alto Networks | Leader | Leader | Slight drop in impact. |

| Aruba (HPE) | Strong Contender | Leader | Big jump into leadership. |

| Riverbed | Leader | Not present | Exited; no longer in matrix. |

| Forcepoint | Strong Contender | Strong Contender | No change. |

| Versa Networks | Strong Contender | Strong Contender | Small downward shift. |

| Cradlepoint | Strong Contender | Strong Contender | Slight leftward drift. |

| Nuage Networks (Nokia) | Strong Contender | Strong Contender | Small rightward shift; steady. |

| Aryaka Networks | Strong Contender | Strong Contender | Minor upward movement. |

| Fatpipe Networks | Leader | SPARK Leader | Holding on. |

| Peplink | Strong Contender | Emerging Innovator | Repositioned as niche innovator. |

| Mushroom Networks | Strong Contender | Missing | Missing. |

| Barracuda Networks | Strong Contender | Aspirant | Slipped to lowest quadrant. |

| Bigleaf Networks | Aspirant | Aspirant | No change. |

| Check Point | Not present | Strong Contender | New entrant in 2025. |

Exploring the rankings:

What does the table tell us about the market situation? For starters, the market is definitely continuing to mature. Most of the leaders have stayed as leaders. This can be clearly witnessed by checking who the leaders are and their positioning in both 2024 and 2025. Most of them are large, diversified players — Cisco, Fortinet, Juniper, Aruba (HPE), and Palo Alto Networks. The only new addition was Aruba, which is likely owing to its edge investments and integration paying off. Apart from this, the leader quadrant shows no fragmentation with many emerging innovators. It is dominated by big established brands who have put in a lot of funding in R&D and innovation.

We can observe a similar situation when it comes to the contenders. Versa Networks, Forcepoint, Cradlepoint, Aryaka, and Nuage Networks have remained in the “Strong Contenders” zone. The companies may be struggling to break through into the leadership tier. A likely factor behind this is despite good technology, the companies may need to work on factors like global reach, brand strength, and/or innovation. Coming to the others, Barracuda and Bigleaf Networks, Bigleaf has remained stationary, while Barracuda has slipped from Strong Contender to Aspirant. Mushroom Networks, a strong contender, has gone AWOL. This confirms that the market is maturing, and niche or legacy appliances won’t survive without major innovation or vertical focus.

Final take:

The SD-WAN market is maturing. The leaders are only big players. In other words, it is no longer a frontier for dozens of scrappy startups. The window for pure-play innovation has narrowed dramatically. However, like many other domains, AI is also witnessing increased adoption. The next phase of the battle is: Who owns the secure, cloud-smart, AI-automated fabric that ties it all together? So, while the market is maturing, don’t be fooled — the next wave will be even more competitive. If you’re not evolving, you’re already sliding.