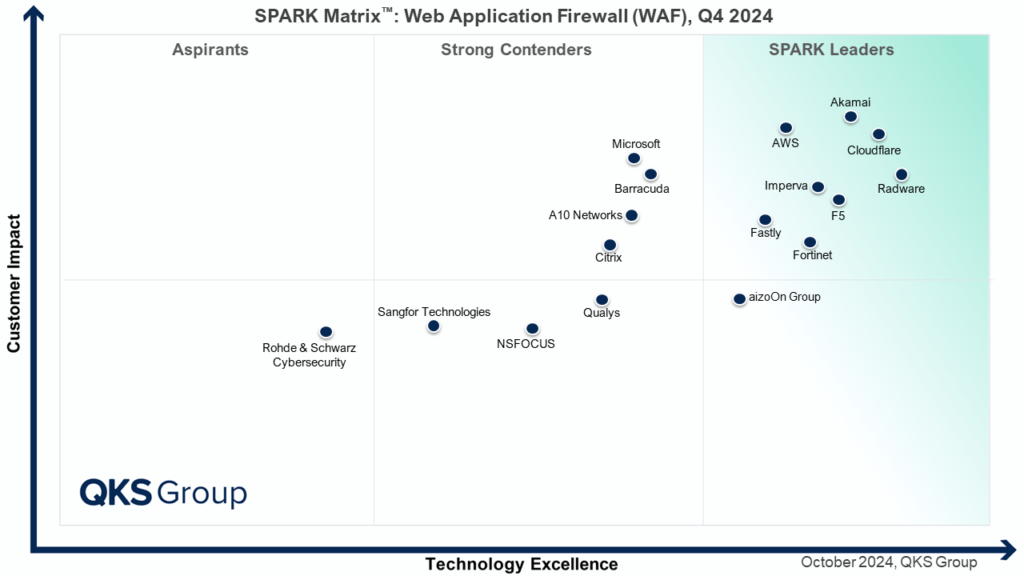

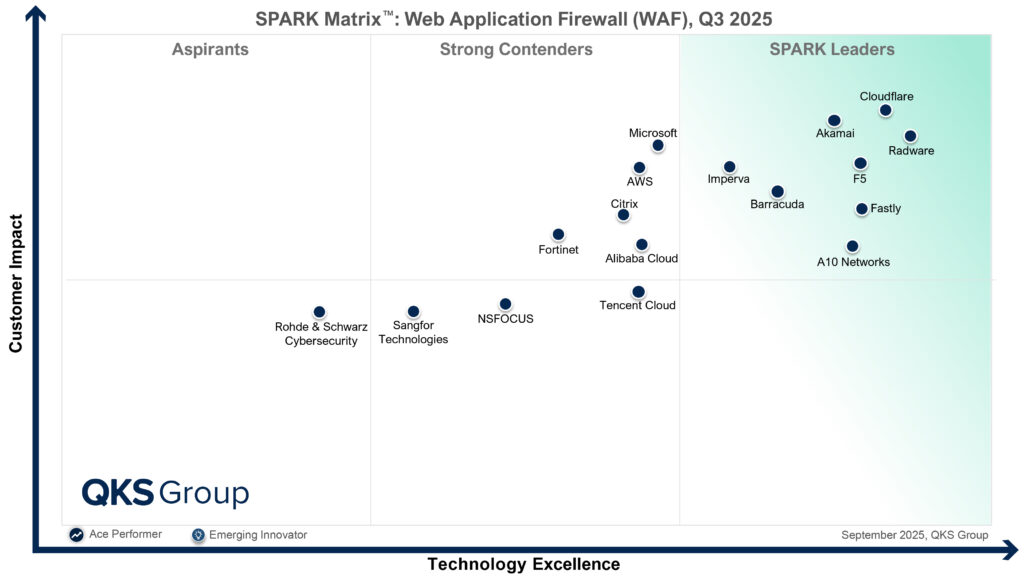

The comparison of the Q4 2024 and Q3 2025 SPARK MatrixTM for the Web Application Firewall (WAF) market suggests that the market has changed from considering the importance of WAF as a control to the criteria by which it is evaluated. WAF is no longer assessed as a standalone security product. Rather, it is judged as part of a broader application security and delivery fabric, and that shift explains why some vendors remain leaders, some advance, and others lose relative ground.

Akamai, Cloudflare, Radware, F5, Imperva, and Fastly remain as leaders in 2024 and 2025. This continued hold is not because of any single capability. Rather, it is because of the companies offering a combination of technology depth, operational maturity, and customer impact. These vendors tend to approach WAF as one component of an integrated platform that includes DDoS protection, bot management, API security, and edge delivery. This ability matters because most modern application risk does not emerge from simple injection attacks alone. It arises from automated abuse, API misuse, and complex traffic patterns that require visibility and enforcement at scale.

Akamai and Cloudflare, in particular, benefit from operating at the edge where applications and users already meet. Their WAF capabilities are reinforced by global telemetry, automated mitigation, and tight integration with adjacent services. Radware’s leadership is easier to understand, considering its long-standing focus on availability and behavioral analysis, particularly in high-throughput environments where performance and resilience are inseparable from security. F5 remains a leader because of its entrenched enterprise footprint and flexibility across on-premises, hybrid, and cloud deployments, although the ongoing pressure is on how effectively that heritage maps to API-centric and cloud-native architectures. Imperva continues to be recognized for its WAF pedigree and data-centric security approach, while Fastly’s position reflects the growing relevance of developer-aligned, edge-native application delivery models.

WAF SPARK Matrix Comparison: 2024 vs. 2025

| Vendor | 2024 Position (Q4 2024) | 2025 Position (Q3 2025) | Likely Factors Behind Positioning / Change |

| Akamai | Leader | Leader | Global edge scale, integrated WAAP capabilities, strong bot and API protection, consistent large-enterprise impact |

| Cloudflare | Leader | Leader | Edge-native architecture, developer-centric tooling, automation, strong API and abuse protection at scale |

| Radware | Leader | Leader | Proven DDoS heritage, behavioral detection, strength in high-throughput and availability-critical environments |

| F5 | Leader | Leader | Deep enterprise footprint, hybrid deployment flexibility, strong ADC–WAF integration; cloud-native execution under scrutiny |

| Imperva | Leader | Leader | Long-standing WAF credibility, data security focus, broad enterprise adoption; execution consistency increasingly evaluated |

| Fastly | Leader | Leader | Edge-first design, developer alignment, strong performance for modern application delivery |

| AWS | Strong Contender | Strong Contender | Native proximity to workloads drives adoption; often viewed as baseline protection rather than differentiated WAF |

| Microsoft | Strong Contender | Strong Contender | Azure-native reach, ease of deployment; limited perception as best-in-class for advanced WAF and abuse scenarios |

| Barracuda | Strong Contender | Leader | Improved execution, operational simplicity, stronger customer impact beyond SMB-heavy base |

| A10 Networks | Strong Contender | Leader | Better execution and visibility in performance-sensitive use cases; improved customer impact |

| Fortinet | Leader | Strong Contender | Strong platform integration, but WAF not primary buying driver; increased competition from edge-first WAAP vendors |

| Citrix | Strong Contender | Strong Contender | ADC heritage supports WAF credibility; strategic clarity and future differentiation remain key challenges |

| Alibaba Cloud | Strong Contender | Strong Contender | Regional cloud dominance (APAC); global enterprise consistency still developing |

| Tencent Cloud | Strong Contender | Strong Contender | Growing relevance in regional markets; limited traction in Western enterprise deployments |

| NSFOCUS | Strong Contender | Strong Contender | Solid technology foundation; regional focus and ecosystem scale constrain broader impact |

| Sangfor Technologies | Strong Contender | Strong Contender | Competitive capabilities; customer impact and global scale remain limited |

| Rohde & Schwarz Cybersecurity | Aspirant | Aspirant | Niche deployments, limited commercial momentum in WAF segment |

| Qualys | Strong Contender | Not Covered | WAF not a strategic focus; market relevance in this segment diminished or deprioritized |

| aizoOn Group | Leader | Not Covered | Appears to have exited or reduced visibility in WAF-focused evaluations |

The movement of other vendors highlights how the bar for leadership has risen. Barracuda and A10 Networks both move from Strong Contender to Leader in 2025. In both cases, this shift appears to reflect improved execution and customer impact, rather than a sudden leap in core technology. In a market increasingly sensitive to operational burden, consistency, and ease of deployment, vendors offering tangible outcomes tend to be rewarded. Leadership here signals that these platforms are being used effectively in real environments, not just evaluated favorably on feature lists.

By contrast, Fortinet moves from Leader in 2024 to Strong Contender in 2025. This change does not suggest a decline in technical capability, but rather a recalibration of how WAF is valued in the broader security stack. Fortinet’s strength lies in its integrated security platform, where WAF is one of many controls rather than the primary focal point. As buyers increasingly evaluate WAF through the lens of application-layer risk, API protection, and edge-scale abuse mitigation, specialist and platform-centric WAF vendors appear to gain a relative advantage. The shift suggests that leadership in 2025 requires WAF to be a strategic centerpiece, not merely a supporting feature.

AWS and Microsoft remain strong contenders across both years. Their WAF offerings benefit from native proximity to workloads and ease of adoption, particularly in cloud-first environments. However, they are often perceived as baseline protections rather than differentiated solutions for high-risk or complex application scenarios. The matrices reflect a market view in which cloud-native does not automatically equate to best-in-class, especially when advanced bot management, behavioral analysis, or multi-environment consistency are required.

Citrix also remains a strong contender, which aligns with its heritage in application delivery. However, its WAF positioning continues to depend on how clearly it articulates its role in modern application security strategies, particularly as customers look for tighter alignment with DevOps workflows and API-driven architectures. Alibaba Cloud and Tencent Cloud appear as Strong Contenders as well, reflecting growing relevance driven by regional adoption, particularly in Asia-Pacific markets. Their placement suggests that while regional scale matters, leadership in the WAF market increasingly depends on global consistency and enterprise-grade operational maturity.

NSFOCUS and Sangfor Technologies remain Strong Contenders with lower customer impact. Their positioning points to capable technology that has yet to translate into broad ecosystem pull or sustained global visibility. Rohde & Schwarz Cybersecurity continues to sit in the Aspirants category, indicating niche deployments and limited commercial momentum in this specific market.

The absence of certain vendors between 2024 and 2025 is also instructive. Qualys and aizoOn Group appear in the 2024 matrix but are not covered in 2025. While absence does not necessarily indicate technical weakness, it does raise questions about strategic focus and relevance within the WAF segment as it is currently defined. In a market where WAF is increasingly bundled into broader application security platforms, vendors whose primary strengths lie elsewhere may struggle to maintain visibility.

QKS Group Security Analyst Lokesh Biswal offers a word of advice. “Organizations aspiring to lead across the modern Web Application Firewall market must move beyond perimeter defense and adopt a unified, API-first security strategy. This move requires investing in intelligent threat detection powered by behavioral analytics and AI, enabling rapid virtual patching, and tightly integrating WAFs with vulnerability management, SIEM, and SOAR platforms. Leaders also prioritize automation, real-time visual analytics, and seamless cloud-native deployments. Most importantly, they align product vision with customer outcomes, delivering measurable risk reduction, operational simplicity, and continuous innovation at scale.”

For CISOs, the value of this comparison lies not in treating the matrices as a ranking exercise, but in understanding the underlying signals. Vendors positioned as leaders tend to demonstrate an ability to reduce application risk at scale while minimizing operational overhead. They are better aligned with how applications are built and delivered today, and they integrate WAF into a broader security and delivery context. Strong Contenders may still be viable choices, particularly when aligned with specific environments or platform strategies, but they warrant closer scrutiny around differentiation, roadmap clarity, and execution.

The broader takeaway from the 2024–2025 comparison is that WAF has become a structural dependency rather than a tactical control. Leadership increasingly reflects a vendor’s ability to adapt to evolving application architectures and threat models, not just to block known attacks. For organizations making long-term decisions, the key question is not whether a vendor is a leader today, but whether its trajectory suggests continued relevance as application environments evolve.